REDESIGN THE IRS REVENUE ACCOUNTING CONTROL SYSTEM

Logapps developed a fully documented Independent Cost Estimate (ICE) for the redesign of the Revenue Accounting Control System (RACS) for the Internal Revenue Service (IRS). Logapps partnered with PRICE Systems and utilized the TruePlanning model as the estimation framework. The study included separate ICEs for the Development and Operations and Maintenance (O&M) phases, benchmarks for productivity, and risk and sensitivity analysis.

CHALLENGE

RACS is a custodial accounting system of record that controls and reports all significant tax processing activities. The Government Accountability Office (GAO) has cited several material weaknesses with RACS pertaining to traceability and noncompliance with the U.S. Standard General Ledger (USSGL). Additionally, GAO identified that RACS is not currently in compliance with the Federal Financial Management Systems Requirements and Federal Financial Management Improvement Act of 1996. RACS’ noncompliance stems from transactional data not being stored with the correct USSGL account structure. To address these weaknesses, Logapps redesigned RACS to provide more robust capabilities to the Chief Financial Office. The client also needed documentation addressing the cost and risk of the RACS program, independent of their internal estimation program office.

APPROACH

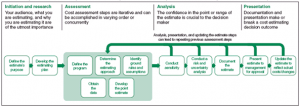

RACS’ size estimate was developed through function point analysis. Under this analysis, size is measured from a functional, or user, point of view. Data from a variety of organizations and Subject Matter Experts were collected and normalized. The team heavily leveraged PRICE Systems’ TruePlanning parametric cost model. This model stored the data and ran multiple parametric equations for hardware and software. TruePlanning also allowed for easy data management, verification of results, and ease of documentation, all in compliance with the GAO cost estimating guidelines.

IMPACT

The TruePlanning modeling approach improved the speed, accuracy, transparency, and standardization of the cost estimation process. By interviewing the client to understand the strengths and weaknesses of the legacy program, Logapps created ground rules to develop parametric models. These models facilitated risk assessment, allowing for schedule and sensitivity analysis. Logapps briefed the results to the client, giving the client the confidence to communicate a realistic view of the likely cost to the Chief Financial Office. This view allowed the client to successfully schedule outcomes and make credible, evidence-based-decisions on future actions swiftly.

Today, budgets are stretched and investment dollars are at a premium. Our proven methodology of delivering economic analysis using market-leading tools, such as TruePlanning, allows for an Analysis of Alternatives (AoA) to be developed quickly and robustly. By expediting the analysis process, solutions can be rapidly deployed, allowing for an early return on investment. We can help your organization make the most economically beneficial investment decision for tomorrow.

WANT TO LEARN MORE? CONTACT US TODAY